I’ve heard my personal finance clients say “I hate saying NO to myself.”

Many people struggle with budgeting and money management because it can feel so restrictive. It can feel like deprivation.

But it doesn’t have to!

Imagine you are out shopping and you see something that you hadn’t planned to buy that really jumps out at you. Perhaps it’s a pillowcase that reads “No Probllama”….

Whatever it is that triggers your impulse to want to buy something, you are then faced with a tough decision: Say “No” to something that would bring you a lot of joy or go over budget and potentially fail to hit your financial goals for the month.

When clients tell me they are struggling with this, my favorite tip for them is to stop saying “No” and start using Purchase Procrastination.

I basically never tell myself “No”.

That might surprise you since I write about frugality almost ad nauseam, but it’s true. Even when I am in an “Emergency Savings Mode”, I still don’t tell myself “No”.

Replace “No” with “Not Yet”

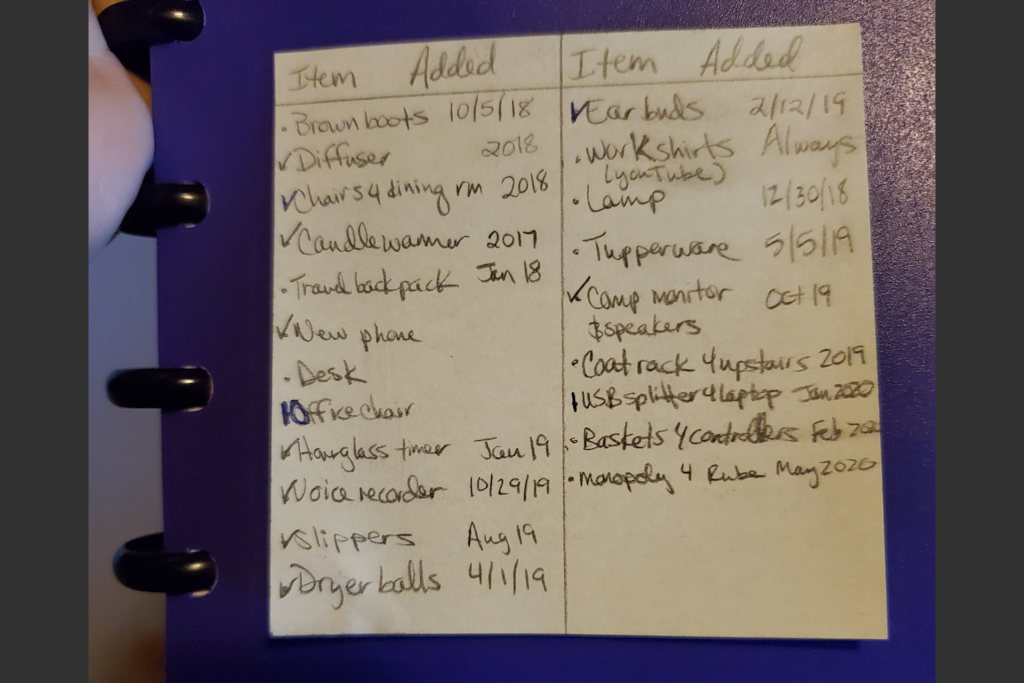

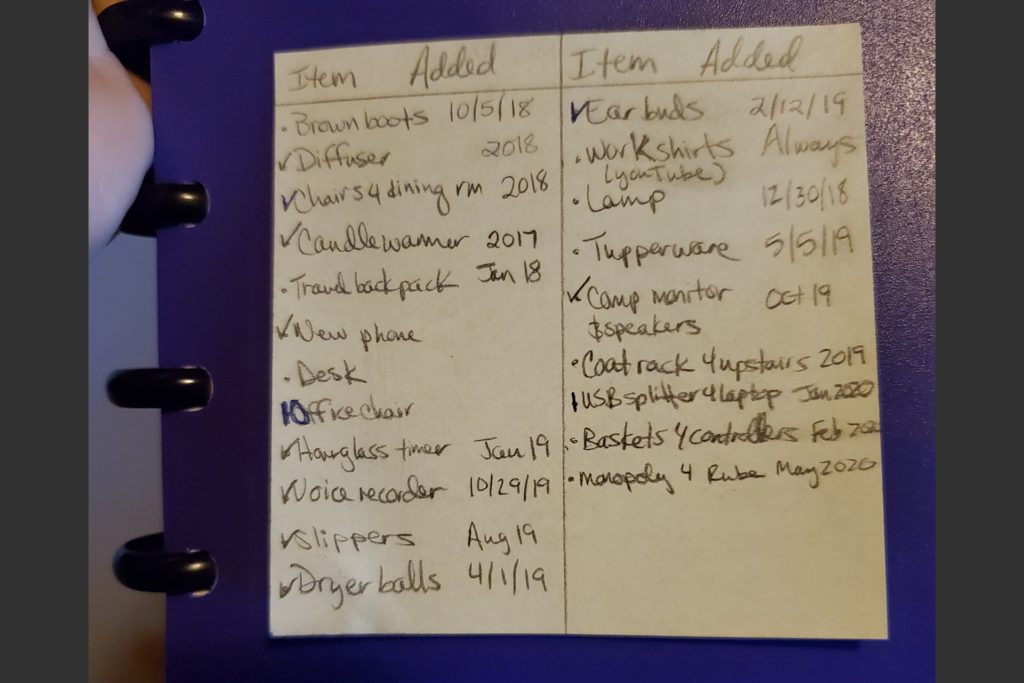

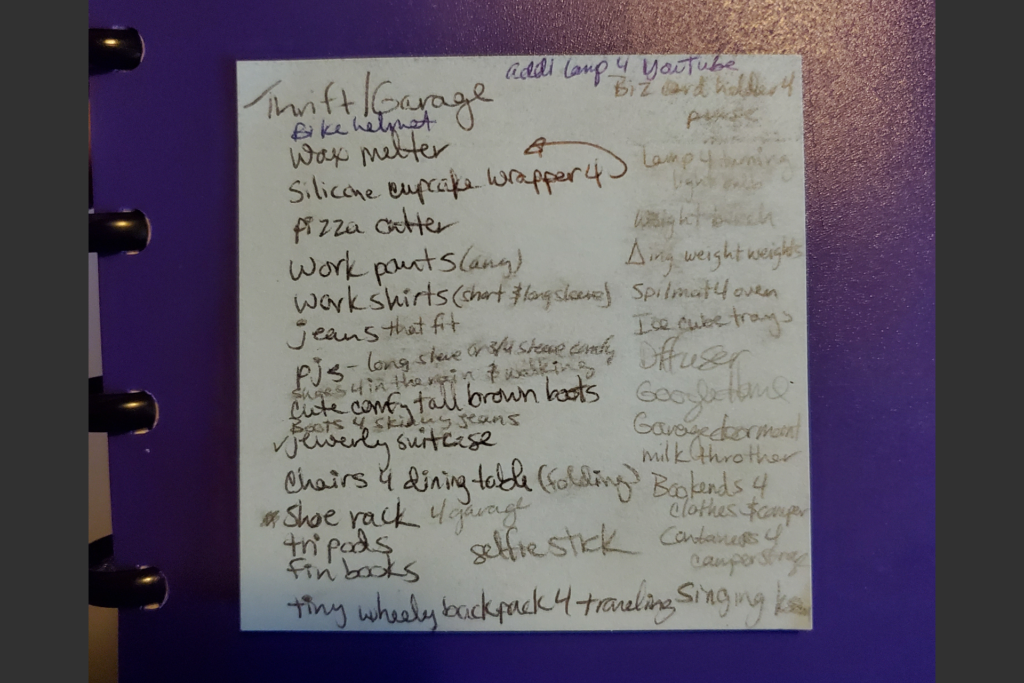

Try replacing “no” with “not yet”. Honor your desire for something by writing it on a purchase procrastination list. I keep a few sticky notes at the front of my disc-bound bullet journal/day planner where I write down the things that strike my fancy that I haven’t budgeted for.

Wait for it…

Wait a predetermined amount of time (you may have heard of the 72 Hour Rule which is basically just 3 days of purchase procrastination) and then re-evaluate if it is something you really want or if it was just an impulse. Buy it if you can afford it and if you still want it.

I typically leave items on my list for a long time, in some cases months or years. If you can wait at least a month, you can incorporate items from the list into the next months’ budget.

Of course, I am not a finance robot (despite accusations in online money forums) so I am not able to do this 100% of the time. In fact, I do have the No Probllama pillowcase above and I did impulse buy it…I have probllamas trying to say no to llamas… But probably 90% of the time I procrastinate unexpected purchases.

Prioritize the “Wants” against each other

Once you have a few items on your list and have waited the amount of time you determined to wait, re-evaluate and prioritize the want list. This helps me see which things were impulses and which are things I truly want and then I can prioritize and work them into future budgets.

Essentially, I promise myself that I can have whatever I want, it’s only a matter of time. Then I just have to decide when the right time is. Can I fit this into June’s budget or should I wait until July?

I actually wrote an entire blog post about how much I love Purchase Procrastination. You can check it out here: Leverage procrastination to save money

It straight up delights me that I can finally use my expert procrastination skills for good!

A Few of the Benefits of Purchase Procrastination:

Minimizes Impulse Spending– This is basically controlled delayed gratification.

My mind changes– Saves money since sometimes I decide that I don’t really want the item after all.

Better Budgeting– Both by not wrecking the current months’ budget but also providing more accurate information when filling out future budgets.

Allows time to find alternatives– I will read the list before going thrift shopping or garage sailing and often find better items for less money than what I saw in the store or online.

Lessens spending guilt- I have long struggled with feeling guilt about spending money on “Wants”. Going through these steps help me to feel better about the purchase. At least I know that I applied some level of discipline to the process and prioritized the “Wants”.

Summary

I find it much easier to say “Not Yet” to myself than saying “No”. It doesn’t feel like deprivation, it feels like intentionality. Honoring the things I want by writing them on the list makes it feel like I’m not just ignoring my desires. I’m respecting my wishes and giving myself a better life at the same time.

For Discussion:

Do you use the 72 Hour Rule or some other form of Purchase Procrastination?