*This post includes affiliate links for the books I am reading.

Goal setting is part art and part science. We have to straddle the line between finding goals that inspire us to take action and goals that are specific, measurable and realistic. Thanks to electronic banking, money is mostly an abstract concept these days. For this reason, I think a lot of people struggle to come up with inspiring and actionable financial goals. Hopefully this post will give you ideas on how to structure your current and future goals for better likelihood of achievement.

I will also feature two great YouTube videos that I discovered in June! Blogs tend to get featured on other blogs but I rarely see YouTube videos or blogs that feature YouTube videos. Whatever the reason, I think it is a shame that some great videos don’t get more love. Each month going forward, I plan to share 1-3 videos in the personal finance category. Do you know of any great videos or channels I could feature? Feel free to Comment with your recommendations below!

Year-To-Date Goal Review

Quarter 1 goals:

#1 Husband Finance Takeover. We did an interesting experiment for our finances for quarter one; I called it a “husband finance takeover” where my husband and I essentially switched the roles we each do for our finances for 3 months. It went really well and we each have a new appreciation for the tasks that the other manages.

#2 Audited each account we have so that we could streamline and close some. (I have a slight problem signing up for too many banking and investing accounts so we had more than 30 accounts!)

#3 Set up a password manager so that Mr. FinanceRox can access all the accounts we kept.

Here is a link to the full blog post if you would like read more:

Quarter 2 goals:

Goal: Two new streams of income

Result: One new side hustle stream! Finally got registered to provide daily habit coaching on Coach.me after 6 months of procrastinating. I’m coaching a habit called “Saving money”. The Coach.me app (which does have free features for tracking progress on goals) focuses on the importance of daily progress and accountability. Clients check in with me each day to share progress on their savings goals and track their spending. If you are interested, you can check out my bio here: https://www.coach.me/coaches/10813/purchase/20814

A few readers have mentioned some of their side hustles. What do you do to bring in more income?

Goal: Do 3 financial challenges

Result: Since Coronavirus hit we have had many No Spend days but didn’t officially do any financial challenges. We will plan some official No Spend Challenges this fall.

Goal: One dine in, one dine out per month.

Result: Completed! We increased our restaurant spending intentionally to support local restaurants with our federal stimulus payment. Plus…ya know… we love food.

Goal: Read 2 Books: Boundaries by Dr. Henry Cloud and Dr. John Townsend and The Richest Man in Babylon by George S. Clason.

Result: Finished Boundaries and almost done with The Richest Man in Babylon.

The Richest Man In Babylon by George S. Clason: https://amzn.to/2BF1BYK (affiliate link)

Boundaries by Dr. Henry Cloud and Dr. John Townsend: https://amzn.to/3gwwUUJ (affiliate link)

July Monthly Goals

Goal #1: Write 50,000 words for book about saving money!!

So excited to finally be prioritizing this side hustle project! I have the bulk of my outline done and a handful of words written. Overall I’m shooting for 65,000 words for the full book. I met an author at the end of last year that has self-published hundreds of books and so she has really inspired me and given me hope that I could write an actual book too. I want to share the things I do to save money and be happy while doing it; so it will be about contentment and frugality.

Goal #2: Keep our spending at $40,000 for the year and save and invest the rest.

We are already running a big budget surplus for the year. As of the end of June we could have spent $20,000 on living expenses to keep on track for this goal but only spent $15,174.

While we do try to keep under $40,000, the other side of this is that we are trying to relax spending since I can be so uptight about money still so we are trying to hit exactly $40,000. The purpose of spending up to $40,000 is really to encourage me to spend without feeling guilt since I feel guilty basically every time I spend on something that is a “want”. Money isn’t just for food and shelter. If we make a lot of money, give a lot of money, save a lot of money, then we should be able to enjoy some of it too.

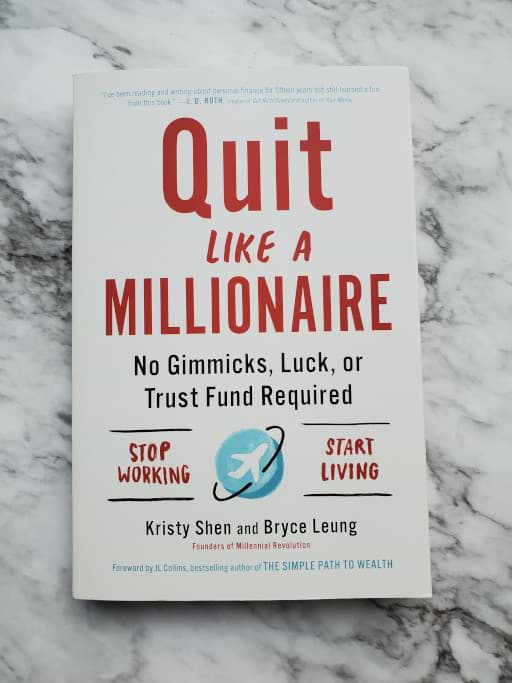

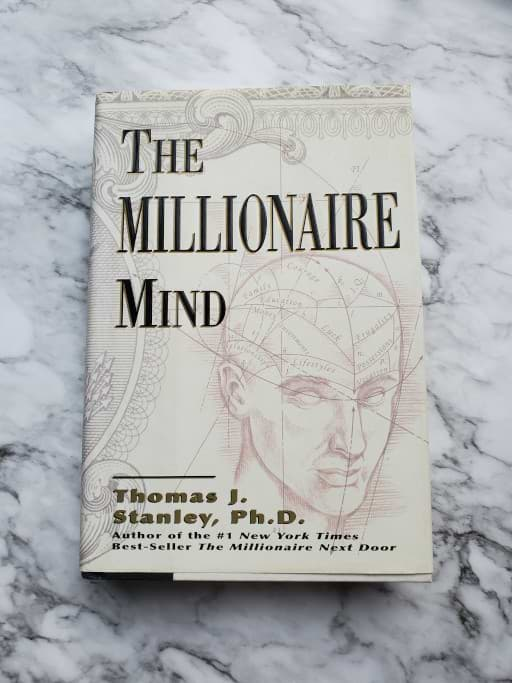

Goal #3: Read 2 Personal Finance Books

Someyear I would love to read 12 books. It has been my ongoing mission for the last several years. I am reading more now than I ever have which is good but still behind where I should be by now. Here are the two books I’m hoping to get through in July:

*Quit Like A Millionaire by Kristy Shen and Bryce Leung: https://amzn.to/2VnNldN

*The Millionaire Mind by Thomas J. Stanley: https://amzn.to/2CErrfK

Goal #4: Continue Weekly Household Money Meeting.

Mr. FinanceRox and I meet every Sunday to manage our finances together. During this time we review spending, pay bills, track our budget, update our net worth, plan food spending etc… We love this routine and want to keep it up.

You don’t have to be married, setting aside time in your calendar each week to work on your finances would accomplish the same purpose.

Goal #5: Try 3 new tips for saving money.

I believe that frugality is a journey not a destination. It’s about becoming more efficient with our money. Therefore I’m always trying to push us to be more creative when it comes to saving money. My gut reaction always says that “We are already frugal, there is nothing else we can cut without reducing happiness”. But I think that is a self-limiting belief. We always do find new ways to save money and often we enjoy the result more once we push past that initial gut reaction.

Here are some of the tips we plan to try in 2020 Q3:

-Make our own oat milk. If you ever questioned the power of coupons for companies, hear this. Mr. FinanceRox has really been enjoying alternative milks like almond and coconut milk so when I saw a $1 off coupon for oat milk, I thought we would try it. He loved it. Now we buy $5 jugs of it whenever it’s on sale but it is still pretty pricey for blended oat water. The good news is that it’s supposedly really easy to make oat milk. We shall see.

-DIY multipurpose cleaner. Always wanted to try this but just never have made the time. Frugal die hards seem to love making household cleaners and I hope to join their ranks.

-Make a solar oven from a pizza box. We wait as long as possible into the summer before setting up our window A/C unit. With strategic timing of opening windows and limiting indoor cooking, we can mostly manage our Montana summers without A/C. We love our grill but it would be nice to have an easy-to-use alternative for little things like making nachos.

-Power outage challenge. I’ve been wanting to try a dopamine detox and figured I would try to combine this to save on electricity cost as well. I’d like to do a 1 day challenge where we don’t use our electronics, lights or appliances.

-Switch from HBO Now to Disney +. We signed up for HBO to watch Silicon Valley and Curb Your Enthusiasm. Now that we are done with those we are going to watch the Mandolorian!

Goal #6: Sell at least one thing we don’t use anymore.

I get really nervous posting things for sale online. I don’t even know why I have such an aversion to it. But we have some bulky items that I’ve been meaning to list for ages and am interested in trying out Poshmark or Mercari as well. Alternatively, we have enough crap to hold a garage sale so we might go that route instead.

Goal #7: Find images for a finance-specific vision/goal board.

There’s a trend on Instagram right now where people are sharing vision boards that are specifically around financial goals. Not sure why I never thought to do this before but the instant I saw it, it was a “hell yes”.

I’m not a very visual person so I struggle to picture my future goals. Vision boards help me to think through what I actually want for my life. I don’t know if I will have time to get the images printed and assembled but in July I want to find some images that will inspire me to stay motivated.

Non-Financial Goals

I always share a few of my non-financial goals just because I enjoy talking about the weird goals I come up with. Exploration is a value that I hold highly so it is fun for me to push myself to come up with new things to try.

Here are some of my non-financial goals that I’m working towards:

Goal #1: Learn to throw knives.

Knives and steel toes boots have been purchased! I need to figure out how to get these out of this intense packaging, put together a target and remember to take it out camping with us.

Goal #2: Create a look-book of outfits.

Do you ever try on 5 different combinations of outfits before you decide what to wear? I do this all the damn time and it’s a waste of damn time. I want to assemble some outfits and take photos of them so that I can just flip through an album and pick the one I want. I always forget if a dress is too long for this pair of shoes or if this shirt is too short for these shorts…. If the look-book doesn’t help make this 10X easier, I swear I’m just going to go all gray tees like Mark Zuckerberg.

Goal #3: Be able to do a pull-up.

I’m sad to report that since the pandemic hit I have fallen off practicing for this goal. I was doing really well when I could go to the gym. Mr. FinanceRox was helping coach me on form and we were practicing about 3 times per week. I’m sure it’s not impossible to work on this at home, I just need to do some research to figure out what exercises to do.

FEATURES

I discovered two videos in June that I really wanted to feature on my blog and YouTube channel.

Video #1 How to ELIMINATE Your Cell Phone Bill by Becoming Financially Fit

Check out Stacy’s video here: https://youtu.be/ETg4eSkvnqI

I laughed out loud at how clever the concept is for this video. Stacy’s advice is to purchase shares in your cell phone company and use the dividends to pay your bill. He does a great job breaking down the math and how to calculate it. It gave me another idea, essentially you could buy stocks for the bank you use and use dividends for building your emergency funds. I like this idea because of a rule I have for investing; I try to only buy stocks in companies I like and frequent. So most of the single stocks I purchase are companies that I buy products from anyway.

Video #2 HOW TO BUILD AN EMERGENCY FUND STARTING TODAY! by Camille Collazo

This video made me cry. Not ball, but there was face moisture for sure. You all know how strongly I feel about having powerful “Why” statements behind your emergency funds and in this video Camille shares a painful experience that she had and how that shaped her emergency fund savings plan.

I also really liked that she keeps an emergency fund specifically for her dog. This is an important category to save for. According to a Lending Tree.com survey: About 42% of millennial pet owners have been in pet-related debt. The average cost of an emergency vet visit is $800-$1500.

Check out Camille’s video here: https://www.youtube.com/watch?v=MC4y4xQUhoA

FOR DISCUSSION:

Let me know, what goals are you working on in July!?