It’s easy to forget that our environment influences us. Habits can be won or lost based on our ability to make them visual and easily accessible in the spaces where we spend the most time.

2 problems with goals:

#1 We forget about ’em

If you are like me, many times have you gotten to the end of the year and thought: “Oh yeah, I forgot that I said I was going to do X, Y and Z.”

#2 Too hard to start, didn’t try

We often feel overwhelmed at the amount of effort that it takes to establish a new habit. We might not realize it, but it is likely that there are barriers that could be mitigated that would make it easier to just get started.

The good news is that we can leverage our surroundings to increase our chances of success with habits and goals.

Let’s look at the classic example of trying to practice playing the guitar more.

The Problems:

-We only remember that we were wanting to practice the guitar when we happen to see it under the bed when digging for that left slipper that slipped itself under there.

-If we do happen to remember to practice, we might not feel like laying belly first on the floor while trying to dig the guitar out from under the bed.

The Solution:

A common solution is to use a guitar stand in a well-used room, instead of keeping it in the case under a bed or in a closet. This provides a prominent visual reminder in the room (the guitar) and it takes just a few seconds to pick up the guitar and start practicing, lessening the barrier to get started.

How can we support our financial goals with our environment?

Here are some of the ways I’ve adjusted my environment to make it a little easier to establish good money habits:

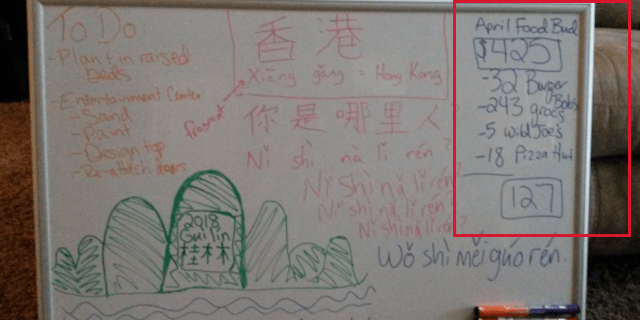

#1 Track spending on a white board

Track one “problem” spending category on a dry erase or chalkboard in your living room or kitchen.

When we were trying to cut our food spending in half, we kept a big whiteboard on our living room floor and wrote on it every dollar we spent on food during the month. We tracked all the groceries, restaurants, fast food, alcohol and coffee.

This allowed us to see the current TOTAL amount we had spent so far as well as the EXACT number of budget dollars we had left. Just walking through the house we knew if we could afford more restaurant trips or not.

The whiteboard was a visual reminder of the goal to cut spending and having it in the living room made it an easy habit to keep up on after entering through the front door.

Strange added benefit: This also helped us remember that we actually DID recently dine out and that helped us feel more “treated” and less deprived. It’s so strange and funny to me just how easy it is to forget those treats. This list essentially became a gratitude list for the tasty meals we already got to enjoy that month.

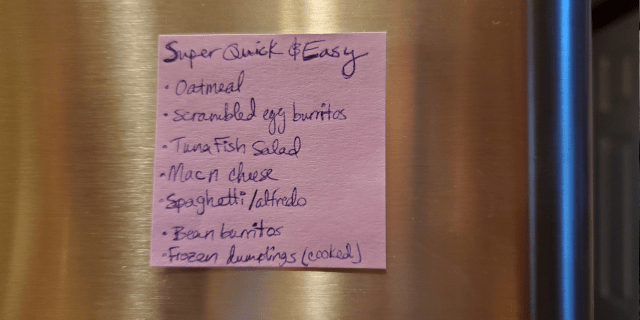

#2 Quick and easy meal list

Keep a list of ultra easy and fast meal ideas on your fridge for those times when you are tempted to order convenience food.

I always forget about those super easy meals that we almost always have the ingredients for like oatmeal, scrambled egg burritos, tuna fish salad, etc…

Having a visible list often saves us from ordering food when tired and/or busy.

What are your go-to, ultra easy meals for busy days?

#3 Vision boards and sticky note reminders

Make a vision board or write your goals on sticky notes to display around your home. This helps keep our goals in top of mind awareness, even when we get caught up in normal day-to-day busy-ness.

Pro tip: Set a reminder to move them around from time to time or else they will start to blend into the environment and then you won’t get the benefit of increased goal visibility.

Digital Environment Tips:

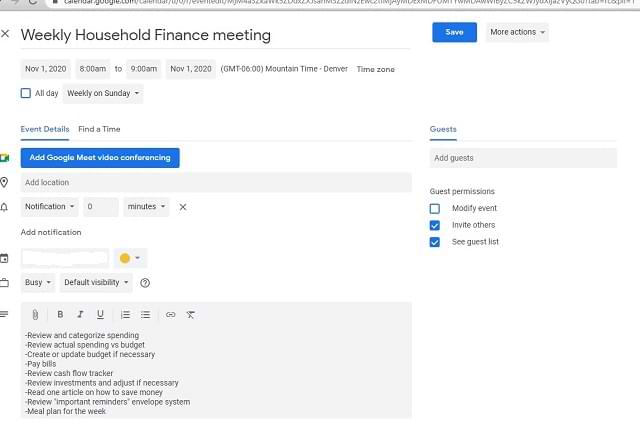

#4 Calendar reminders

Use calendar reminders as a trigger for performing your money habits. For example, I have a weekly calendar reminder for every Sunday morning so we don’t forget to review our spending, update our budget, pay bills and handle other financial matters that help us stay on track for our goals.

It wouldn’t necessarily need to be a calendar reminder, any kind of reminder on your computer or desk could be the trigger you use to make your habit/goal more visible.

To make this goal easier to start, you could even pop up a fresh new banking tab each time you finish so it is ready to go next time you are ready.

#5 Unsubscribe

Unsubscribe from email lists that tempt you to spend money. Reducing visibility on financial habits we want to minimize will also help us stick with our budgets.

The nice thing about email lists is that you can easily sign up again after you achieve your goal.

FOR DISCUSSION:

What do you do to increase your chances of success with your financial goals?

These are great tips! I use Mint as my virtual white board to the same effect. Love the calendar reminder idea!

Pingback: Top 10 Personal Finance Articles of the Month — October 2020

Pingback: 25 Best Personal Finance Articles of 2020