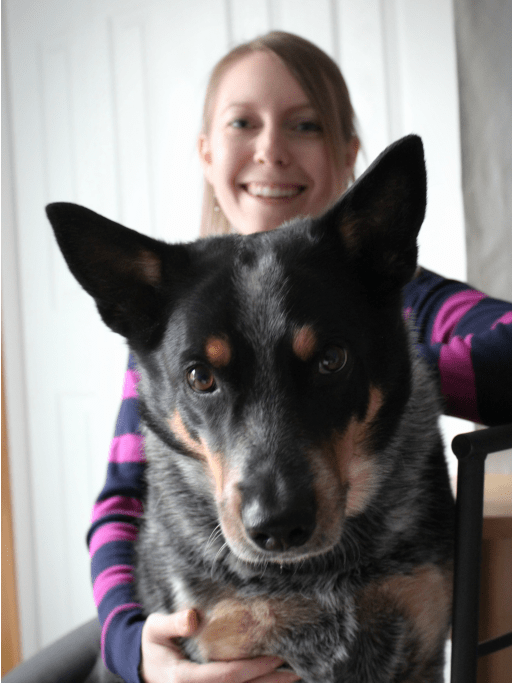

My best 4-legged friend is a sassy blue heeler/border collie mix.

I noticed the other day after a shared workout that he has 3 modes and only 3 modes:

#1 All out sprinting after a thrown ball

#2 Our laid back jogging trot speed

#3 Sprawled out, panting, on the kitchen tiles afterward to catch his breath and rest

Thinking about how I’ve managed money on my journey from the federal poverty line to 4% wealthiest for our age group, I have had 3 similar modes that I have alternated between as necessary. Each mode requires different skill sets and each mode has taken some effort to learn how to do effectively.

I believe that if you can adopt these three modes and learn how to intentionally activate and de-activate each, you will be more in control of your finances and can supercharge your progress towards your financial goals.

The 3 Modes:

#1 Sprinting Mode

Like my dog chasing that ball, full out with his life, this mode is for single focusing with intensity to make big progress quickly.

In Sprint Mode, I limit my purchases to true necessities; food, water and shelter. This mode was especially helpful when I was trying to get back on my feet after being unemployed.

What did this look like? It looked like…No hair cuts, no Thanksgiving with my family, only walking to work and a strict diet of bananas, rice and potatoes.

I do “No Spend Challenges” now intermittently to interrupt my daily spending patterns and to refresh my gratitude meter.

#2 Trotting Mode

Our jogs are less intense than sprinting but we are still making progress towards the destination.

Trotting is about endurance. This mode is the baseline and should be where we are most of the time. Financially, we are working and we are saving a moderate amount; whether it is currently going towards debt, emergency funds or savings.

We need to structure our regular daily habits and routines so that we can save money easily. Like all endurance activities, it’s important to find ways to enjoy the long haul journey and try to streamline and optimize to make the journey easier.

We should have systems or software that allow us to categorize and reviewing our spending easily each week or month. We should know our total assets and liabilities (net worth) and we should be actively managing our money.

#3 Resting Mode

Resting Mode is for recovery from the other modes and is necessary during difficult times in our lives when it is not appropriate to be focused on money; like when my Dad had heart surgery two years ago.

When you are in the hospital with a loved one, that is the time when we need to give our full focus and attention to the people we love.

Financially, this means trying not to backslide into more debt, if possible, and it also means not pressuring ourselves to make forward progress either. We all need to rest and catch our breath sometimes and we need to give ourselves permission to breathe.

All 3 of these modes are important and we need to be able to identify when is the right time for each.

Getting stuck in one mode

Here are some of the common problems I’ve seen when it comes to these 3 Financial Modes.

Sprinting too hard for too long

I’ve noticed that many of my personal finance coaching clients believe that they need to be in Sprint Mode 100% of the time. They feel guilty and angry with themselves if they aren’t sprinting.

Sometimes this is based in the very real need to save money and sometimes it is just a remnant of the expectation that they set for themselves when they did need to sprint aggressively.

However, trying to work around the clock and spend $0 perpetually is simply unrealistic and leads to burnout and binge spending. We have goals, we need to make change, but we also need to be kind to ourselves and not push ourselves into exhaustion.

Trotting to mediocrity

While trotting is where we want to be most of the time, it is beneficial to mix in sprints and rest. Even in high school when I participated on our cross country running team, our coach made us do short sprints every day.

Sprints wake up the body and they wake up our finances. Interrupting our daily habits is the best thing we can do to stave off lifestyle creep because going temporarily without spending helps bring self awareness TO our spending.

Focusing temporarily on a single money goal with intention and focus helps us make more noticeable progress and helps us feel accomplished.

Constant trotting also denies us Resting Mode which is important for mental health and a good relationship with money.

Perpetual Resting Mode

Some people are in a constant state of preoccupation with other areas of their life. Lets just call this what it is: financial negligence. No progress is made while resting so that means progress isn’t really made to make more or save more money. If you are never able to prioritize your finances, even for a short period of time, money can become a perpetual problem.

You might be surprised to hear that one point or another, I’ve been guilty of all 3 of these “I’m stuck” scenarios!

-Got stuck in sprinting mode for several months after going broke and several months when paying off debt and did get burnt out multiple times.

-After we bought our house, I became very complacent financially. We were making and saving money but I was not giving my finances any real effort and never made the conscious decision to rest.

-I definitely am guilty of neglecting my finances the summer that I was unemployed. I spent almost no time applying for jobs and slowly backslid, spending all but $200 of my savings.

FOR DISCUSSION:

Which mode are you in right now with your finances?

Which mode should you be in right now?